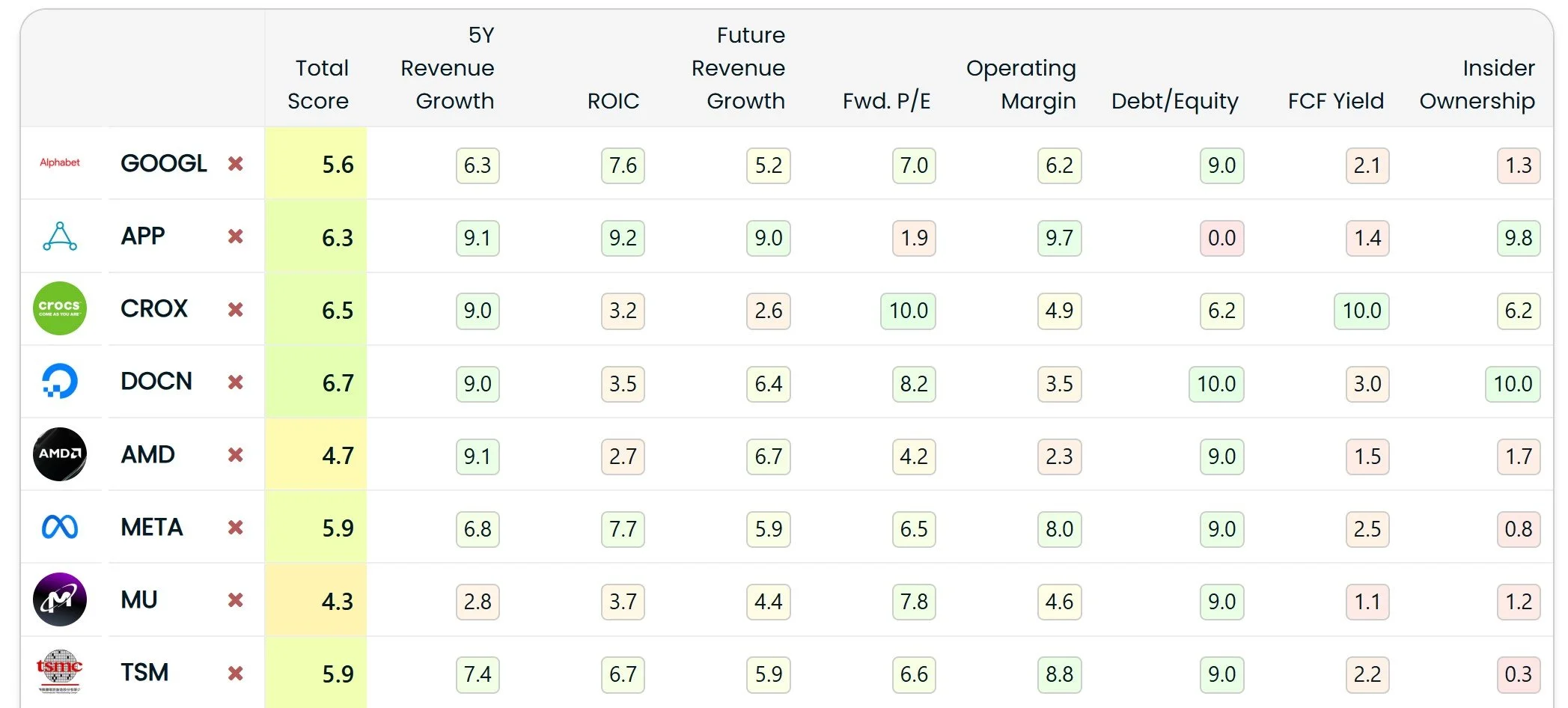

Stock Score Table: Rank and Compare Stocks Easily

Discover the Stock Score Table - an interactive stock comparison tool that ranks companies by custom metrics, weights, and scores to find the best stocks to buy.

Everything Is Priced In. Here's How to Win Regardless!

You’re not beating hedge funds on information. But that’s okay — you don’t have to. This post breaks down the real advantages retail investors have over institutions, and how you can use speed, flexibility, and contrarian thinking to outperform, even when the market seems "efficient."

How to value stocks by company type?

Learn how to value public companies based on their business type—mature, growth, early-stage, or dividend-paying—using models like Discounted Cash Flow (DCF), pevaluation, Future P/E valuation, the Graham formula with growth, and the Dividend Discount Model (DDM). Find out which methods work best for different companies and how to get more accurate fair price estimates with our platform.

Best Stock Analysis Tools for 2025

Picking the best stock analysis tool comes down to what you’re after. GuruFocus is for the deep thinkers, Simply Wall St keeps it simple, Finchat and Finbox bring AI to the party, and Koyfin’s got the data junkies covered. But if you want a tool that bends to your investing style, PEvaluator’s my top pick.

Which Companies Have Wide Economic Moats? Top Picks for 2025

Wide moat companies are the foundation of a strong investment portfolio. By focusing on companies with wide economic moats, investors can reduce risk while tapping into businesses with sustainable profitability. In this post, we explore why wide moat companies matter and how identifying them can lead to smarter, more profitable investment decisions.

PEvaluation - an alternative, customizable, stock valuation model

A high-level view of "PEvaluation", the stock market valuation technique that lets investors define market models that align with their investment style and goals.

5 books every investor should read

A list of 5 must-reads for all investors, new or seasoned.

The little tool that beats the market

Building on The Little Book That Beats The Market, pevaluator takes value investing to the next level, giving investors access to the tools needed to value companies.

Everything you need to know about dividends

Dividends are a way to return value to shareholders.